The seven largest stocks in the S&P 500 are igniting a remarkable rally, delivering a combined 92% return.

Expectations that the Magnificent 7 global technology companies will increase earnings due to the use of artificial intelligence are very significant to U.S. stock investors.

Due to their disproportionate weight in the index, the so-called 'Magnificent Seven' stocks—Apple Inc. (AAPL), Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), Amazon.com, Inc. (AMZN), NVIDIA Corporation (NVDA), Tesla, Inc. (TSLA), and Meta Platforms, Inc. (META)—have experienced significant rallies that have driven nearly all of the S&P 500's 12% year-over-year gain. The remaining 493 companies, on the other hand, have only grown by 5%, indicating a markedly unbalanced market.

This quarter, the AI-driven stock market boom was starting to weaken until Nvidia Corp.'s spectacular earnings reestablished the market. Early in September, Nvidia's stock price was close to all-time highs as data centre operators stocked up on the company's processors to handle the intensive workloads demanded by AI.

The S&P 500 is up around 12.5% in 2023, which is a notable recovery from the lows of 2022. Although this performance is excellent, recent research by stock market experts highlighted some rally-related concerns.

The Magnificent 7 Total Returns Index has surged by 93% in 2023, thanks to record earnings, and valuations are in line with their five-year averages.

Among the notable companies, Amazon, Tesla, Nvidia, and Alphabet all have price-to-forward-earnings ratios that are below their five-year averages when compared to the performance and values of the Magnificent 7 index. After experiencing a record-breaking stock decline last year, Meta is now back on track. Notably, Nvidia's stock is trading at a level two standard deviations below its typical valuation, as indicated by PEG ratios, while Microsoft is trading one standard deviation below. PEG ratios take long-term earnings growth projections into account.

The US economy is still expanding, and the S&P 500 index, which gauges the performance of US blue-chip stocks and serves as a benchmark for investors worldwide, has increased by more than 14% this year.

Since the 1970s, the S&P 500 index's performance has never been more concentrated. Seven of the largest components have surged higher this year, increasing by between 40% and 180%: Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta. Overall, the remaining 493 companies are stable. The index is completely dominated by large tech corporations. Almost a quarter of the market capitalization of the entire index is comprised of just five of those seven stocks. Apple alone is valued at $2.9 trillion, which is more than the top 100 UK-listed companies combined.

The chipmaker Nvidia has increased its market capitalization by $640 billion just this year by riding the wave of investor interest in artificial intelligence and ripping up its own revenue guidance for the upcoming quarters in favour of more optimistic predictions. The combined market value of the two largest US banks, JPMorgan and Bank of America, is virtually equal to that amount.

Sameer Samana, senior global market analyst at the Wells Fargo Investment Institute (WFII), said of the Magnificent Seven, "Everybody knows these individuals are going to make money." The only question is: How fast is that earnings growth, and have investors overpaid for it?"

In June, the Wells Fargo Investment Institute lowered the rating of the technology industry, which includes Apple, Microsoft, and Nvidia, to "neutral" from "favourable."

Results from Microsoft, Alphabet, Amazon, and Meta, the parent company of Facebook, are anticipated for the next week, while Apple and Nvidia will publish their results the following month.

Tajinder Dhillon, senior research analyst at LSEG, predicts that the S&P 500 as a whole will experience a 2.3% fall in 2023, compared to a 32.8% profit increase for the megacap businesses.

The steady rise in interest rates and Treasury yields, which has been fueled by a combination of Federal Reserve hawkishness in the face of a robust economy and concerns over the U.S. fiscal picture, complicates the outlook.

More positive is Goldman Sachs. This month, it raised its prediction for the S&P 500's end-of-year level, predicting that it would hit 4,500, a rise of 12.5% from its prior prediction and roughly 3% higher than where it was on Wednesday afternoon. If the bank is correct, this will be one of the index's best years in the past 20 years.

Investors attention will be focused on big tech earnings in the upcoming week as Amazon (AMZN), Alphabet (GOOGL), Meta (META), and Microsoft (MSFT) are scheduled to release their earnings reports.

Earnings Date: 24 October, 2023 (Tuesday)

Earnings Date: 24 October, 2023 (Tuesday)

Earnings Date: 25 October, 2023 (Wednesday)

Earnings Date: 26 October, 2023 (Thursday)

Facebook's daily active users fell short of analyst expectations. Meta Platforms Inc. has dropped more than 25% after it released a disappointing earnings report on Wednesday.

Meta stock fell in extended trading on Wednesday after Facebook owner Meta Platforms released its fourth-quarter earnings report, sending the company's stock down 23% in after-hours trading Wednesday and nearly 20 percent in Thursday's premarket. It was the first set of quarterly results for Facebook's parent company, Meta, under its new name.

Earnings per share fell 5% year on year to $3.6, falling short of forecasts of $3.8.

The stock is on track for its biggest one-day drop ever, surpassing the 19% drop it experienced in July 2018.The loss on Thursday is expected to reduce its market capitalization by roughly $210 billion, lowering it to around $689 billion.

Facebook is investing more aggressively in products that make less income in the immediate term but have high growth potential, such as Reels on Instagram. The company's primary social media business, reported under its family of apps, generated $32.79 billion in sales and $15.89 billion in operating profits in the quarter.

However, it should be noted that overall income increased in the three months to December, rising to $33.7 billion from $28.1 billion at the same time last year. Net income was $10.3 billion for the quarter, down roughly $1 billion from the previous year. Despite this, Meta is a highly wealthy and lucrative company.

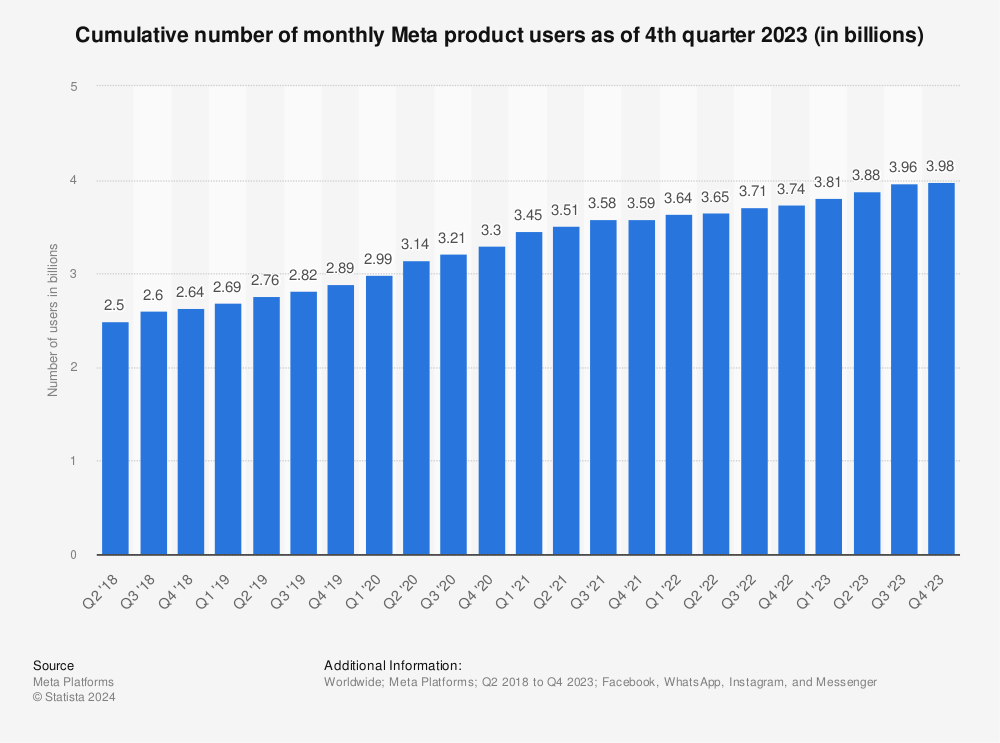

Facebook's daily active users fell short of analyst expectations, totaling 1.929 billion in the three months to the end of December, compared to 1.84 billion in the same period last year. They were down from 1.93 billion in the prior quarter. It saw its first drop in daily active users since the company's inception in 2004. A reduction in the number of individuals who check in to Facebook every day indicates that the company's core product has achieved saturation in global markets, meaning that it may no longer be able to grow its user base.

Facebook's monthly user base remained largely stable at 2.91 billion.