Nvidia's Q1 earnings report exceeded analysts' estimates on revenue and earnings per share.

After the market closed, NVIDIA Corporation (NVDA), the chip giant, released its first-quarter earnings report. Nvidia's graphics chips for gaming and data centers are projected to be in high demand. Earnings exceeded Wall Street projections on revenue and earnings per share. $8.29 billion in revenue vs $8.10 billion estimated. $1.36 earnings per share, compared to $1.30 estimated, $3.62 billion in gaming vs the estimated $3.53 billion and Data Center $3.75 billion vs the estimated $3.63 billion.

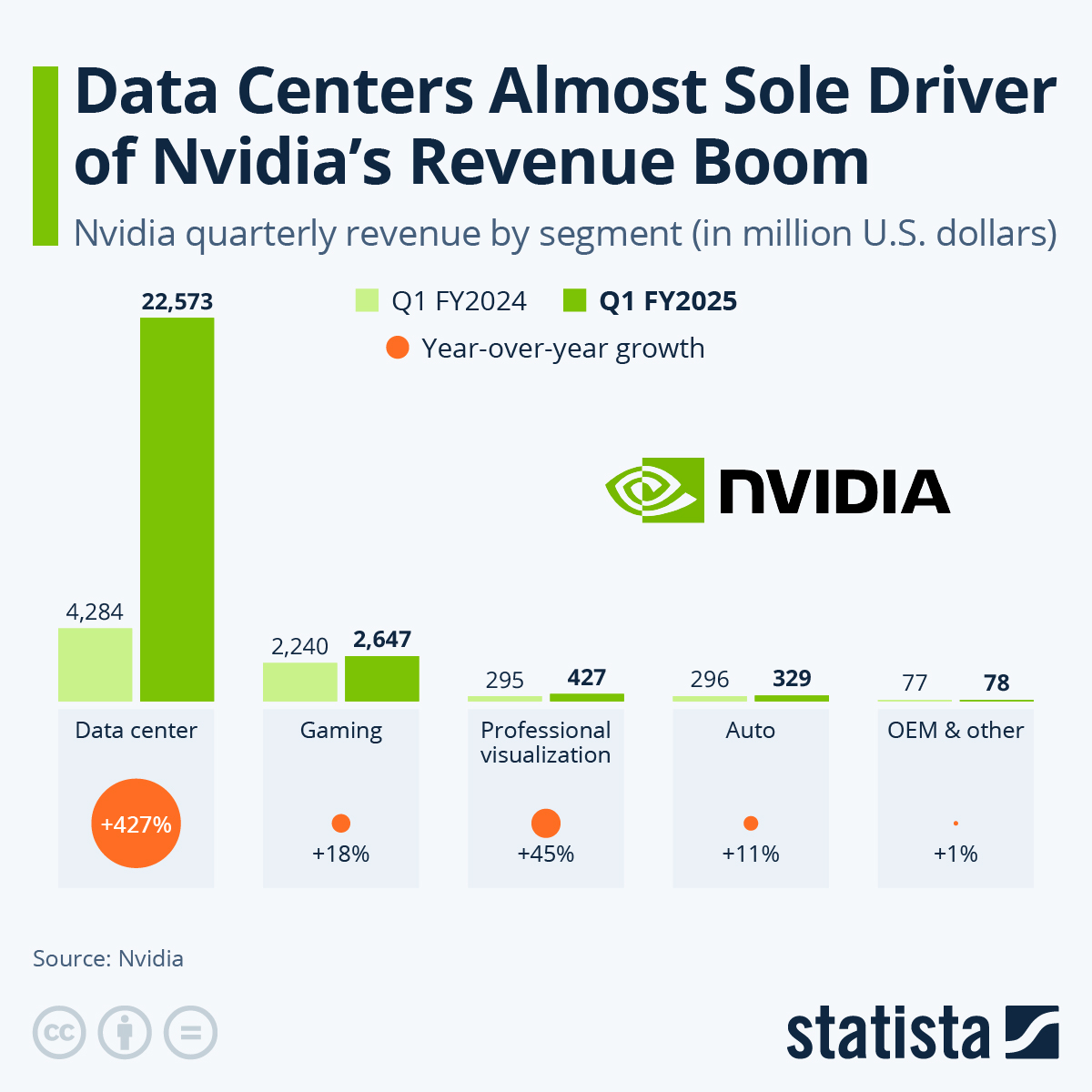

While some experts are concerned about how the slowdown in the technology industry may affect chip manufacturers, one analyst feels there may be a silver lining. Data center demand has been resilient, and it might be a lifeline for chip manufacturers like Nvidia attempting to shore up their bottom lines.

Nvidia, on the other hand, fell short of its sales targets for the second quarter. The company expects $8.1 billion in revenue in the current quarter, while Wall Street was anticipating $8.44 billion. Nvidia stated in a statement that an anticipated $500 million decrease is linked to Russia and the COVID lockdowns in China.

Nvidia shares dipped in the extended session Wednesday after COVID shutdowns in China and the crisis in Ukraine reduced the chip maker's expectations for the current quarter by half a billion dollars, despite the business reporting record profits.

After hours, Nvidia shares fell 7% after rising 5.1 percent to $169.75 during the regular session.

Nvidia's earnings come at a time when tech companies have been particularly battered as part of a larger market selloff. Nvidia shares are down more than 28% in the previous three months, while AMD (AMD) shares are down more than 20%.

AMD's stock has recently been struggling to recover from a five-week slump. In the midst of this collapse, the firm posted great profitability and provided strong projections. Though it has traded lower in the last two weeks, it has only lost 2%. In comparison to the S&P 500 and Nasdaq, which both fell 5.4 percent and 6.5 percent, AMD stock performed admirably. The stock is again back on the radar of traders.

The bulls are often attempting to regain control of the market. If they do, AMD stock is likely to be a popular option. AMD at $85.50, the 61.8 percent retracement from the late-2021 high to the March 2020 COVID low occurs.

That level served as support before, during, and after the company's earnings announcement on May 3. AMD stock is stuck between $85 and $100, with the sliding 10-week moving average acting as a barrier. While the stock has reclaimed this level of active resistance at times, it has not closed above it on a weekly basis since late March.

Before that, bulls would have to travel all the way back to late 2021 to locate the last time AMD closed above the 10-week moving average.

Qualcomm (QCOM) shares have also dropped 22%.Meanwhile, Intel (INTC) has managed to keep approximately in step with the S&P 500, with shares falling more than 9% compared to the index's 7% decrease.

Graphics cards are finally returning to shop shelves after months of devastating supply chain problems, which is critical for Nvidia and gamers. That's not to imply that chip scarcity is over; far from it.

Intel CEO Pat Gelsinger estimates that the scarcity will last until 2024, implying that we are still a long way from resuming pre-pandemic availability for many semiconductors.

However, Nvidia's and AMD's GPUs are becoming more affordable as bitcoin prices fall. When the price of cryptocurrency falls, so do card prices, as miners shift their focus away from buying up available supply to create coins.

In the following months, Nvidia is also likely to launch its next graphics card portfolio. The cards, dubbed the RTX 4000-series, should deliver a nice performance improvement over the company's existing RTX 3000-series line, as well as increase Nvidia's bottom line.

Nvidia's shares tumbled on Thursday, despite the fact that the company reported its fourth-quarter earnings on Wednesday that exceeded Wall Street's forecasts.

On February 16, 2022, Nvidia Corporation posted Q4 FY results that were above forecasters' estimates. Adjusted earnings per share increased 69.2 percent year over year, exceeding analyst expectations. In the most recent quarter, the graphics-chip manufacturer reported $7.64 billion in revenue, a 53 percent increase over the previous year. Analysts' projections for data center revenue were surpassed. In extended trading, the company's stock slid about 2%. Nvidia's shares have produced a total return of 73.1 percent over the last year, far outperforming the S&P 500's total return of 13.8 percent. It reported $3 billion in net profits, more than double the previous year's number, and outperformed Wall Street on both profit and sales. As it moves on from its unsuccessful acquisition effort of semiconductor-design specialist Arm Ltd, the firm reported record quarterly sales throughout its business and forecasted an increase in the current period. Investors are anticipating a strong earnings report from Nvidia, which is still experiencing all of the demand it can manage from gamers and cloud giants.

Nvidia Corp. fell 7% in pre-market trade on Thursday after the chipmaker reported better-than-expected fourth-quarter results but provided a cautious view on profit margins in the short term. Despite exceeding Wall Street forecasts with its fourth-quarter earnings and forecasting good growth for the current period, the share loss is a reflection of Wall Street's high expectations following Nvidia's withdrawal from a $40 billion acquisition of Arm Ltd. earlier this month.

Nvidia's data center revenue increased 71.5 percent year on year, outpacing the prior quarter's growth rate. Colette Kress, Nvidia's Chief Financial Officer, stated that data center revenue was largely driven by sales of Nvidia Ampere architecture GPUs. Last quarter, there were some hiccups. Nvidia's vehicle processors were sold at a lower rate than expected. And its adjusted gross margin was 67 percent, which was lower than the 67.1 percent predicted by analysts and lower than what several chipmakers have recently reported. Analog Devices Inc. reported a 72 percent margin in its quarterly earnings released earlier Wednesday.

Nvidia had record gaming sector revenues of $3.42 billion, as well as an all-time high in data center revenues of $3.26 billion, but slowing sales of its "CMP" chips, which are used by cryptocurrency miners, added a degree of concern to the chipmaker's outlook, with gross margins likely remaining at 67 percent in the current quarter. The firm has long focused on manufacturing chips for the gaming and graphics industries, and it was a pioneer in the creation of GPUs. It turns out that the powerful processing capabilities used by GPUs to power video games and graphics applications are also well-suited for artificial intelligence (AI) and machine learning. Both of these technologies are becoming more essential in the constantly expanding data center business. During the pandemic, demand for remote computer power surged significantly as more individuals began working from home and businesses were compelled to transfer certain activities online. This advancement has contributed to an increase in demand for Nvidia's data center CPUs.

The company's CEO, Jensen Huang, discussed the company's supply chain problems. "In the next quarters, we expect supplies to improve," he added. The business claimed it has $9 billion in long-term supply agreements, up from $2.54 billion a year earlier, as an indication of how it is tackling supply chain concerns.

Increased attention to the metaverse, a virtual environment based on technologies such as virtual reality (VR) and augmented reality (AR), is expected to drive up demand for the company's data center processors. Nvidia revealed in January that Meta Platforms, Inc. aims to use NVIDIA DGX A100 computers to develop the metaverse of their AI Research SuperCluster (RSC). Meta's AI supercomputer is likely to be Nvidia's DGX A100 systems' biggest client installation.

Following a January-quarter tally of $7.64 billion, Nvidia plans to produce roughly $8.1 billion in revenue in Q1 FY 2023, reflecting a YOY rise of nearly 42 percent. On May 12, 2022, Nvidia is expected to release their next earnings report for Q1 FY 2023