Nvidia's stock is one of the best tech stocks to invest in this year.

Nvidia Corporation (NVDA) is one of the few tech stocks that is still trading near its all-time highs.

Nvidia Corporation maintains a robust balance sheet, positive cash flow creation, and an appealing long-term growth story. Despite macroeconomic challenges, this company's robust balance sheet and excellent profit margins are an obvious plus.

Nvidia has demonstrated an ability to sustain significant secular growth while retaining substantial profit margins during cyclical troughs in recent years.

Nvidia's stock soared about 95% in 2023, with its rising position in AI making it a more appealing purchase. The release of OpenAI's ChatGPT last November sparked an AI arms race in which many businesses rushed to join the market, hoping to gain a piece of the $208 billion pie. Given that the industry is expected to reach approximately 800% to $2 trillion by 2030, it's no wonder that so many tech companies have shifted their focus to AI development. Meanwhile, because of its profitable semiconductor business, Nvidia is in a good position to earn considerably from that expansion.

Nvidia's stock has risen as a result of its powerful CPUs, which have become the standard for building AI software. The firm is ChatGPT's major provider of graphics processing units (GPUs), which used around 20,000 units in 2020. Meanwhile, TrendForce data suggests that figure might soon climb to 30,000 as the platform prepares for commercialization. As a result, Nvidia's income might skyrocket as demand for its GPUs surges.

The capacity of Nvidia to offer GPUs to the whole market makes its stock more appealing. The company's potential is demonstrated by its price/earnings-to-growth ratio of 0.4, indicating that its expected stock growth has not yet been factored into its shares.

According to financial analysts, Nvidia Corp. is one of the companies expected to become the next Apple (AAPL) in terms of tremendous growth in 2023.

Nvidia was named a "top pick" by Evercore analysts in a client note on May 1. Analysts at Rosenblatt Securities also listed Nvidia as one of seven semiconductor firms that might profit from increased technology expenditure on artificial intelligence (AI).

On May 1, IBD selected Nvidia as its Stock of the Day as the chipmaker broke through. Investors may exploit the current Nvidia breakout to initiate a modest trade or increase an existing one. However, the current market trend calls for caution while investing.

The chip stock has been named to the renowned IBD Leaderboard. Nvidia shares reached the 20% profit-taking target from a prior breakthrough in April. As it happens, over the past three months, 46 Wall Street analysts have provided their ratings on Nvidia's stock, with 31 advocating a 'strong buy,' 3 recommending a 'buy," and 12 suggesting a 'hold,' whereas there were no supporters for either 'sell' or 'strong sell,' as per data retrieved by Finbold on May 2.

On November 16, 2022, Nvidia and Microsoft announced a multi-year partnership to create one of the most potent AI supercomputers in the world. This supercomputer will be equipped with NVIDIA GPUs, networking, and the full stack of AI software to enable enterprises to train, deploy, and scale AI, including large, cutting-edge models. With hundreds of NVIDIA A100 and H100 GPUs, NVIDIA Quantum-2 400Gb/s InfiniBand networking, and the NVIDIA AI Enterprise software suite added to its platform, it is the first public cloud to use NVIDIA's cutting-edge AI stack. Read here.

The AI-optimised virtual machine instances on Microsoft Azure are built with NVIDIA's most sophisticated data centre GPUs and are the first public cloud instances to have NVIDIA Quantum-2 400 GB/s InfiniBand networking. Customers may use hundreds of GPUs in a single cluster to train even the largest language models, develop the most sophisticated recommender systems at scale, and allow creative AI at scale.The NVIDIA H100 Transformer Engine will be utilised by Microsoft DeepSpeed to speed transformer-based models used for huge language models, generative AI, and producing computer code, among other things. DeepSpeed's 8-bit floating point accuracy capabilities are used in this technology to substantially expedite AI computations for transformers — at double the throughput of 16-bit operations.

Microsoft and NVIDIA announced a 10-year cooperation on February 21, 2023, to deliver Xbox PC titles to the NVIDIA® GeForce NOWTM cloud gaming service, which has over 25 million subscribers in over 100 countries. Read here.

Gamers will be able to stream Xbox PC titles from GeForce NOW to PCs, macOS, Chromebooks, cellphones, and other devices as part of the arrangement. After Microsoft's acquisition of Activision is complete, it will also allow Activision Blizzard PC titles such as Call of Duty to be broadcast on GeForce NOW.

The collaboration gives players more options and addresses NVIDIA's worries about Microsoft's acquisition of Activision Blizzard. As a result, NVIDIA is pledging its full support for the acquisition's regulatory clearance.

The fabless chipmaker pioneered graphics processing units, or GPUs, to improve the realism of video games. It is becoming more prevalent in AI processors, which are utilised in supercomputers, data centres, and medicine discovery. Nvidia's GPUs serve as accelerators for other firms' central processing units, or CPUs. Nvidia processors are also employed in Bitcoin mining and self-driving electric automobiles. Nvidia has also made a significant investment in metaverse applications.

Microsoft and AMD recently announced a collaboration to build new AI hardware that might dethrone Nvidia as the market leader. This collaboration intends to develop hardware that will bring powerful artificial intelligence capabilities to personal PCs and data centres, with the objective of offering more efficient and cost-effective AI workload solutions.

The move represents a substantial market change and might pose a big challenge to Nvidia's existing supremacy in the AI hardware field.

According to a Bloomberg report, Microsoft is assisting AMD in the creation of its proprietary AI processors, known as Athena, as the two companies team up to challenge Nvidia's 80% market dominance.

Amazon Web Services (AWS) is now providing clients with on-demand access to up to 20,000 Nvidia Hopper H100 GPUs for their AI processing needs, allowing them to construct and train large language models (LLMs) and generate generative AI apps. Meanwhile, Microsoft has already deployed thousands of Nvidia GPUs to support ChatGPT, and more may be deployed when generative AI is integrated into other services.

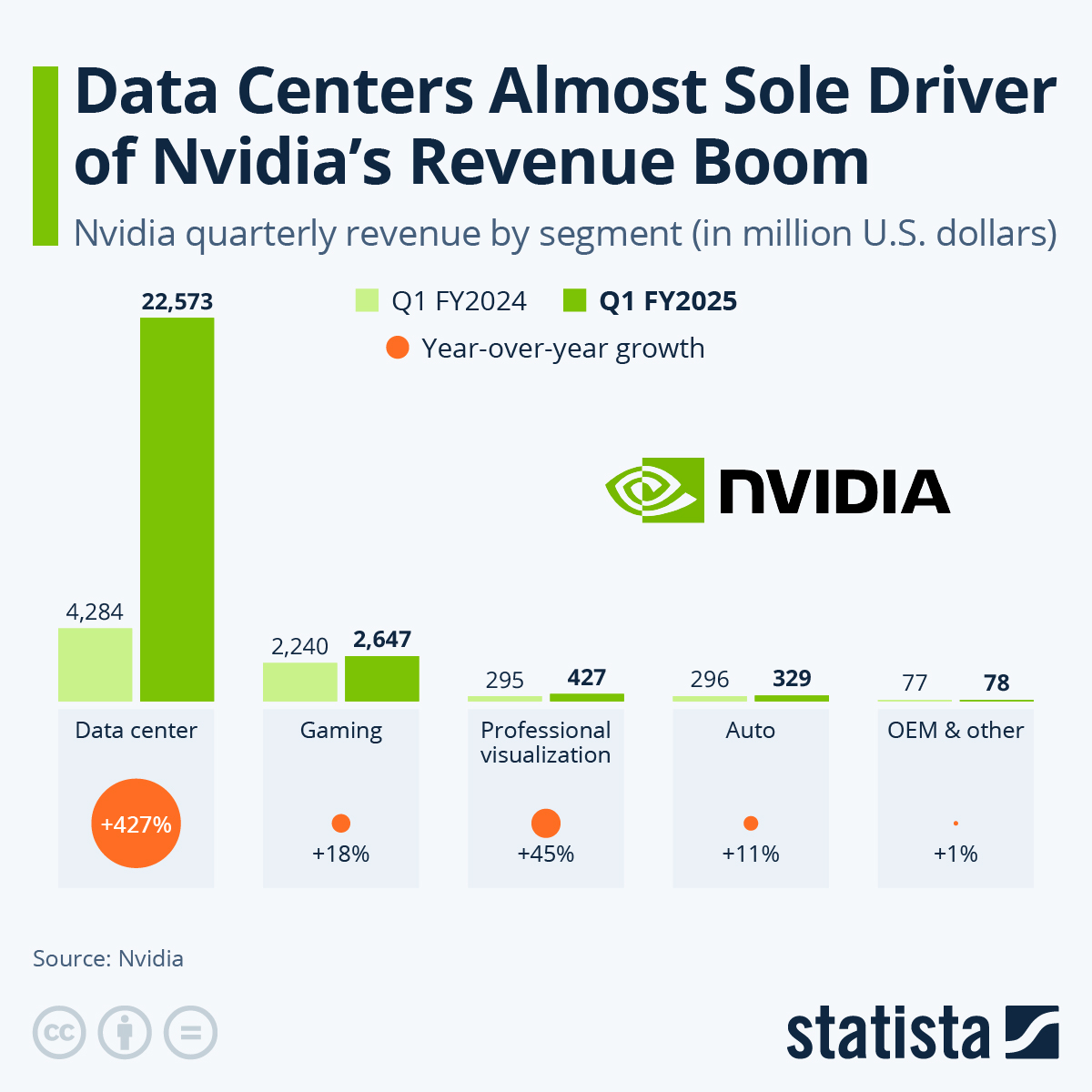

Citigroup estimates that ChatGPT will generate between $3 billion and $12 billion in revenue for Nvidia over a 12-month period. Even at the lower end of Citi's prediction, it would be considerable given the revenue earned by Nvidia's data centre division last fiscal year. However, Microsoft isn't the only company using Nvidia's GPUs for generative AI, so it's not unexpected to see this technology shift the needle for the chipmaker and drive the growth of its data centre business.

(Reuters) - The United States implemented microchip export curbs last year to halt China's development of supercomputers needed to create nuclear weapons and artificial-intelligence systems such as ChatGPT, but the consequences for China's tech industry have been negligible.

Shipments of Nvidia Corp. and Advanced Micro Devices Inc. processors, which have become the worldwide technology industry's standard for building chatbots and other AI systems, were prohibited.

However, Nvidia has developed processors for the Chinese market that are slowed down to comply with US regulations. According to industry analysts, the latest one, the Nvidia H800, unveiled in March, would likely take 10% to 30% longer to perform various AI jobs and potentially quadruple some prices when compared to Nvidia's fastest U.S. processors.

Even the slower Nvidia processors are an upgrade for Chinese companies. Tencent Holdings, one of China's leading internet businesses, predicted in April that systems based on Nvidia's H800 would reduce the time required to train its largest AI system by more than half, from 11 days to four days.

According to financial data firm S3 Partners, short sellers in Nvidia Corp. have lost $5.09 billion this year while the stock has risen more than 90%. According to the report, Apple short sellers have lost $4.47 billion so far in 2023, while the stock has increased approximately 30% in that time. Tesla short sellers have lost $3.65 billion this year, while the stock has risen approximately 33%.

For the year to date, short interest in Nvidia has decreased by 7.04 million shares, or 18%. According to the business, short interest is at 1.32% of the float, the lowest level since October 2022.

Nvidia remained the top choice of analysts due to its AI prospects. Nvidia is constantly one to watch as a top chip manufacturer with exposure to high-end markets.

On May 24, 2023, following market close, NVIDIA Corporation is anticipated to release earnings. The report will cover the fiscal quarter that ends in April 2023. According to Zacks Investment Research, the average EPS expectation for the quarter is $0.61 and is based on 12 analysts' predictions. During the same period last year, the reported EPS was $1.18.

Nvidia's Q1 earnings report exceeded analysts' estimates on revenue and earnings per share.

After the market closed, NVIDIA Corporation (NVDA), the chip giant, released its first-quarter earnings report. Nvidia's graphics chips for gaming and data centers are projected to be in high demand. Earnings exceeded Wall Street projections on revenue and earnings per share. $8.29 billion in revenue vs $8.10 billion estimated. $1.36 earnings per share, compared to $1.30 estimated, $3.62 billion in gaming vs the estimated $3.53 billion and Data Center $3.75 billion vs the estimated $3.63 billion.

While some experts are concerned about how the slowdown in the technology industry may affect chip manufacturers, one analyst feels there may be a silver lining. Data center demand has been resilient, and it might be a lifeline for chip manufacturers like Nvidia attempting to shore up their bottom lines.

Nvidia, on the other hand, fell short of its sales targets for the second quarter. The company expects $8.1 billion in revenue in the current quarter, while Wall Street was anticipating $8.44 billion. Nvidia stated in a statement that an anticipated $500 million decrease is linked to Russia and the COVID lockdowns in China.

Nvidia shares dipped in the extended session Wednesday after COVID shutdowns in China and the crisis in Ukraine reduced the chip maker's expectations for the current quarter by half a billion dollars, despite the business reporting record profits.

After hours, Nvidia shares fell 7% after rising 5.1 percent to $169.75 during the regular session.

Nvidia's earnings come at a time when tech companies have been particularly battered as part of a larger market selloff. Nvidia shares are down more than 28% in the previous three months, while AMD (AMD) shares are down more than 20%.

AMD's stock has recently been struggling to recover from a five-week slump. In the midst of this collapse, the firm posted great profitability and provided strong projections. Though it has traded lower in the last two weeks, it has only lost 2%. In comparison to the S&P 500 and Nasdaq, which both fell 5.4 percent and 6.5 percent, AMD stock performed admirably. The stock is again back on the radar of traders.

The bulls are often attempting to regain control of the market. If they do, AMD stock is likely to be a popular option. AMD at $85.50, the 61.8 percent retracement from the late-2021 high to the March 2020 COVID low occurs.

That level served as support before, during, and after the company's earnings announcement on May 3. AMD stock is stuck between $85 and $100, with the sliding 10-week moving average acting as a barrier. While the stock has reclaimed this level of active resistance at times, it has not closed above it on a weekly basis since late March.

Before that, bulls would have to travel all the way back to late 2021 to locate the last time AMD closed above the 10-week moving average.

Qualcomm (QCOM) shares have also dropped 22%.Meanwhile, Intel (INTC) has managed to keep approximately in step with the S&P 500, with shares falling more than 9% compared to the index's 7% decrease.

Graphics cards are finally returning to shop shelves after months of devastating supply chain problems, which is critical for Nvidia and gamers. That's not to imply that chip scarcity is over; far from it.

Intel CEO Pat Gelsinger estimates that the scarcity will last until 2024, implying that we are still a long way from resuming pre-pandemic availability for many semiconductors.

However, Nvidia's and AMD's GPUs are becoming more affordable as bitcoin prices fall. When the price of cryptocurrency falls, so do card prices, as miners shift their focus away from buying up available supply to create coins.

In the following months, Nvidia is also likely to launch its next graphics card portfolio. The cards, dubbed the RTX 4000-series, should deliver a nice performance improvement over the company's existing RTX 3000-series line, as well as increase Nvidia's bottom line.

Nvidia's shares tumbled on Thursday, despite the fact that the company reported its fourth-quarter earnings on Wednesday that exceeded Wall Street's forecasts.

On February 16, 2022, Nvidia Corporation posted Q4 FY results that were above forecasters' estimates. Adjusted earnings per share increased 69.2 percent year over year, exceeding analyst expectations. In the most recent quarter, the graphics-chip manufacturer reported $7.64 billion in revenue, a 53 percent increase over the previous year. Analysts' projections for data center revenue were surpassed. In extended trading, the company's stock slid about 2%. Nvidia's shares have produced a total return of 73.1 percent over the last year, far outperforming the S&P 500's total return of 13.8 percent. It reported $3 billion in net profits, more than double the previous year's number, and outperformed Wall Street on both profit and sales. As it moves on from its unsuccessful acquisition effort of semiconductor-design specialist Arm Ltd, the firm reported record quarterly sales throughout its business and forecasted an increase in the current period. Investors are anticipating a strong earnings report from Nvidia, which is still experiencing all of the demand it can manage from gamers and cloud giants.

Nvidia Corp. fell 7% in pre-market trade on Thursday after the chipmaker reported better-than-expected fourth-quarter results but provided a cautious view on profit margins in the short term. Despite exceeding Wall Street forecasts with its fourth-quarter earnings and forecasting good growth for the current period, the share loss is a reflection of Wall Street's high expectations following Nvidia's withdrawal from a $40 billion acquisition of Arm Ltd. earlier this month.

Nvidia's data center revenue increased 71.5 percent year on year, outpacing the prior quarter's growth rate. Colette Kress, Nvidia's Chief Financial Officer, stated that data center revenue was largely driven by sales of Nvidia Ampere architecture GPUs. Last quarter, there were some hiccups. Nvidia's vehicle processors were sold at a lower rate than expected. And its adjusted gross margin was 67 percent, which was lower than the 67.1 percent predicted by analysts and lower than what several chipmakers have recently reported. Analog Devices Inc. reported a 72 percent margin in its quarterly earnings released earlier Wednesday.

Nvidia had record gaming sector revenues of $3.42 billion, as well as an all-time high in data center revenues of $3.26 billion, but slowing sales of its "CMP" chips, which are used by cryptocurrency miners, added a degree of concern to the chipmaker's outlook, with gross margins likely remaining at 67 percent in the current quarter. The firm has long focused on manufacturing chips for the gaming and graphics industries, and it was a pioneer in the creation of GPUs. It turns out that the powerful processing capabilities used by GPUs to power video games and graphics applications are also well-suited for artificial intelligence (AI) and machine learning. Both of these technologies are becoming more essential in the constantly expanding data center business. During the pandemic, demand for remote computer power surged significantly as more individuals began working from home and businesses were compelled to transfer certain activities online. This advancement has contributed to an increase in demand for Nvidia's data center CPUs.

The company's CEO, Jensen Huang, discussed the company's supply chain problems. "In the next quarters, we expect supplies to improve," he added. The business claimed it has $9 billion in long-term supply agreements, up from $2.54 billion a year earlier, as an indication of how it is tackling supply chain concerns.

Increased attention to the metaverse, a virtual environment based on technologies such as virtual reality (VR) and augmented reality (AR), is expected to drive up demand for the company's data center processors. Nvidia revealed in January that Meta Platforms, Inc. aims to use NVIDIA DGX A100 computers to develop the metaverse of their AI Research SuperCluster (RSC). Meta's AI supercomputer is likely to be Nvidia's DGX A100 systems' biggest client installation.

Following a January-quarter tally of $7.64 billion, Nvidia plans to produce roughly $8.1 billion in revenue in Q1 FY 2023, reflecting a YOY rise of nearly 42 percent. On May 12, 2022, Nvidia is expected to release their next earnings report for Q1 FY 2023