Tesla Megapack will power the open-source, solar-powered Bitcoin mining facility with Blockstream and Jack Dorsey's Block.

Block (previously Square) and Blockstream, a Bitcoin infrastructure business, are partnering with Tesla (TSLA) to build a Bitcoin mining operation that will demonstrate that BTC can be used to fund zero-emission power infrastructure.

The facility will be powered by Tesla's 3.8-megawatt solar PV array and its 12-megawatt-hour Megapack, and work on it has begun.

The facility's 30 petahashes per second mining hardware will be powered entirely by solar energy, thanks to a mix of Tesla photovoltaics and Megapack battery storage. The Bitcoin mining facility will be finished later this year, with Blockstream supplying the mining technology and expertise to design and operate the operation.

According to a press statement shared with Yahoo Finance, the $12 million project would generate 3.8 megawatts of renewable energy and display a publicly accessible performance dashboard once finished.

Climate activists, ESG investors, and Bitcoin miners continue to discuss the energy intensity of Bitcoin mining in the political realm. Part of the issue is that most of the data on mining energy use is still too fresh to offer historical context and is frequently self-reported.

The Cambridge Bitcoin Electricity Consumption Index found that Bitcoin's overall energy consumption (143 terawatt hours per year) is more than that of Ukraine, but it also admitted that comparing Bitcoin's energy consumption to a nation without extra context can be difficult.

Blockstream co-founder and CEO Adam Back, a British cryptographer and a cypherpunk crew member, told CNBC on the sidelines of the Bitcoin 2022 conference in Miami that the mining operation is intended to be a proof of concept for 100% renewable energy bitcoin mining at scale.

In a news statement, Adam Back, CEO and co-founder of Blockstream, said, "We are very happy to begin building this facility utilizing Tesla Solar and Megapack." "This is a step toward validating our premise that Bitcoin mining can support zero-emission power infrastructure while also fostering future economic growth."

The facility is expected to be finished "later this year." When it's up and running, a public dashboard will provide "real-time measures of the project's success, such as electricity generation and Bitcoin mined." The dashboard will be accessible "24 hours a day, seven days a week, from any browser, presenting the industry with a real-world, real-time case study of a zero-emission energy Bitcoin mine," according to the plan.

In an interview with CNBC, Back noted, "People like to dispute the numerous issues that have to do with Bitcoin mining." "Let's just prove it," we reasoned. Have an open dashboard so that anybody can play along, and perhaps it will alert more gamers to join in. "

The dashboard will be open to the public and will provide real-time information about the project's success, such as electricity generation and total bitcoin mined. According to the business, a future version of the dashboard would incorporate solar and storage performance data points.

Blockstream and Block, formerly known as Square, announced in June that they would work together to establish an open-source, solar-powered bitcoin mining facility in the United States.

A bitcoin is produced when powerful computers compete against one another to solve complicated mathematical riddles, a time-consuming process that presently relies heavily on fossil fuels.

In early 2021, Tesla spent $1.5 billion on Bitcoin. Shortly after, the company began accepting bitcoin as payment for new automobiles.

On the other hand, Tesla, on the other hand, took a step back with cryptocurrency a few days later by deleting the Bitcoin payment option. The businesses expressed worry about the Bitcoin network's energy requirements:

This was a worry echoed by many Tesla community members when Tesla originally revealed its Bitcoin investment, and many were outraged that the corporation hadn't considered it in the first place.

Tesla stated at the time that they were not selling their Bitcoin holdings and that they intended to begin accepting Bitcoin payments once the network had a larger proportion of renewable energy. Elon Musk, Tesla's CEO, stated last summer that he hoped the company would begin accepting Bitcoin payments if the energy mix of Bitcoin mining improved. That has yet to materialize, but Tesla is already actively involved in using sustainable energy to fuel Bitcoin mining.

The project is already under development, according to the firms. Once completed, they want to share performance data on a monthly basis to demonstrate the economics of powering crypto mining with renewable energy. In the United States, West Texas is a renewable energy powerhouse. However, much of the wind and solar energy in the state is located in isolated areas. There is no motive to invest in renewable infrastructure to harness this energy if there is no financial incentive.

Bitcoin miners are the people who create bitcoins. When these energy consumers co-locate with renewables, it generates a financial incentive for buildout while also improving the underlying economics of renewable power production, which has been volatile.

According to Castle Island Venture's Nic Carter, miners offer demand for these semi-stranded assets, making renewables in Texas commercially viable.

The restriction is that West Texas has around 34 gigatonnes of electricity, five gigatonnes of demand, and only 12 gigatonnes of transmission. Consider bitcoin miners to be short-term purchasers who keep energy assets operating until the grid can absorb them completely. Back stated that the off-grid mine, which is anticipated to be finished later this year, exemplifies another essential aspect of the bitcoin network: miners are location agnostic and can "perform it from anyplace without local infrastructure." Back stated that if the project is lucrative in its pilot stage, the firms would add wind power to the mix and grow the entire project.

"You're calculating the ideal economic mix of solar and storage," Back explained. "There are 3.8 megawatts of solar and one megawatt of mining, so you can see you need to overprovision since peak solar input changes over the day and, of course, it's not there at night."

Adding wind to the mix, on the other hand, would lower total expenses and help balance out the downtime caused by solar.

Sen. Elizabeth Warren (D-MA) is one of the most outspoken critics of the Bitcoin mining sector in the United States. Warren and other senators addressed a letter to several prominent Bitcoin-mining businesses in late January, voicing concerns about their energy use and highlighting how Bitcoin's overall energy consumption increased between 2019 and 2021.

According to Ark Invest research, the mining sector generates 76 percent of its electricity from renewable sources, making it significantly more renewable than the overall US energy system and beneficial for recovering otherwise squandered natural gas.

Block's global ESG lead and project lead for Block's Bitcoin Clean Energy Initiative, said Neil Jorgensen. "By partnering on this full-stack, 100 percent solar-powered bitcoin mining initiative with Blockstream, we want to further accelerate bitcoin's synergy with renewables.".

Tesla had a strong first quarter of 2022, setting a new all-time record for deliveries and beating the previous peak.

Tesla stated earlier today that it manufactured over 305,000 vehicles and delivered over 310,000 vehicles in the first quarter of 2022, despite continued supply chain problems and production shutdowns.

Tesla will release its fiscal results for the first quarter of 2022 after the market closes on Wednesday, April 20, 2022.

Tesla produced more all-electric vehicles in the first quarter than any of the twelve analysts polled by Bloomberg yesterday. According to estimates, Tesla would deliver 309,158 automobiles globally from its three operational manufacturing locations. Tesla's Model S, 3, X, and Y are now manufactured in Fremont, California. Internationally, Tesla's Shanghai factory manufactures the Model 3 and Model Y, while its newest unit in Germany, known as Gigafactory Berlin, manufactures the Model Y.

Tesla Model 3 and Model Y car deliveries accounted for 95 percent, or 295,324, of total deliveries in the first quarter of 2022, according to Tesla. Tesla manufactured 14,218 Model S and X automobiles and delivered 14,724. The total number of cars manufactured and delivered was 305,407 and 310,048 respectively.

The automaker cited "ongoing supply chain problems and facility shutdowns" for producing 4,641 fewer cars than it shipped during the quarter.

According to FactSet projections as of March 31, analysts predicted 317,000 car deliveries in the first three months of 2022. The forecasts varied from a low of 278,000 to a high of 357,000 car deliveries.

Tesla shipped 184,800 electric vehicles and built 180,338 units over the same period last year.

Despite a sluggish automobile industry, Tesla defied all expectations and achieved significant year-over-year growth. Tesla experienced a 93.2 percent increase in car sales during this time period, while the other major manufacturers all experienced losses of at least 5.9 percent. suffered a significant loss of 27.6 percent, GM suffered a loss of 16.5 percent, and Volkswagen suffered the greatest loss of 44.3 percent.

Despite rising vehicle costs owing to "inflation pressure," Tesla reported a strong first-quarter performance. Elon Musk, CEO of Tesla, stated that both Tesla and SpaceX were suffering from the effects of inflation, which would affect the cost of their products. Tesla raised the prices of its automobiles by up to $12,500, but buyers were unable to resist. Indeed, as a result of rising gasoline prices, Tesla reported a 100 percent increase in order volume in some areas of the United States.

For the first time in its history, Tesla is on track to deliver 1,000,000 automobiles in a single year. With over 936,000 deliveries between Fremont and Shanghai in 2021, Tesla is almost one-third of the way there in 2022. With Gigafactory Berlin starting deliveries and Gigafactory Texas getting closer to turning over its first cars to customers, Tesla is well-positioned to deliver 1,000,000 vehicles with the four operating factories. However, there may be some unanticipated complications linked to production halts since the Shanghai facility took a temporary break from manufacturing activities. The company was scheduled to resume production on April 2.

Deliveries are the closest approximation to Tesla's reported sales figures. On March 22, the firm held a ribbon-cutting event to commemorate the opening of a new facility in Brandenburg, Germany. On April 7, Tesla plans to hold a grand opening and "cyber rodeo" event at another new vehicle assembly factory it is developing in Austin, Texas. Tesla formally relocated its headquarters to Austin on December 1, although it continues to run its first electric car manufacturing facility in Fremont, California.

As a result of the Ukraine conflict, gas prices are likely to increase, boosting demand for electric cars. However, economists say that a scarcity of inventory and increased vehicle pricing would limit sales.

After Musk warned the US electric automaker was suffering from considerable inflationary pressure in raw materials and logistics as a result of Russia's invasion of Ukraine, Tesla hiked prices in China and the United States in March.

"Impressive (delivery) given all the challenges," said Gene Munster, managing partner at Loup Ventures, who added that Tesla will continue to outpace other manufacturers in terms of sales growth.

Colin Langan, an auto analyst at Wells Fargo, told Yahoo! Finance in January 2022 that he was a little short of Tesla's projection of 50% growth.

I'm a little short of their 50% growth prediction. By the second half of the year, I expect it to be difficult. It's possible that they won't be tested if there isn't enough up semi supply for them to produce 50% growth. "

He went on to say that he doubted Tesla's ability to sell cars, and his model mirrored that sentiment. Morgan Stanley was also worried, particularly about Giga Berlin. Tesla, on the other hand, has proven itself once again, and once Giga Austin begins production, Tesla will have four facilities producing entirely electric automobiles throughout the world.

In October, Musk said that Shanghai had surpassed the production of the company's original facility in Fremont, California. Because production at Tesla's new facilities is projected to ramp up slowly in their first year, the two factories are key to the company's objective of increasing deliveries by 50% this year.

Tesla began shipping cars built at its Gruenheide, Germany, facility in March, and deliveries of cars made at its Austin, Texas, plant are expected to begin soon.

Tesla's stock jumped after the firm said this week that it would seek investor permission to expand its share count in order to allow for a stock split. So far this year, Tesla's stock has climbed around 3%, while GM and Ford's stock have fallen.

Tesla's operations were hampered globally during the quarter, which ended March 31, by a COVID spike and new health regulations in China, which necessitated temporary production halts at its Shanghai factory. Tesla delivered 308,600 electric vehicles in the fourth quarter, a new high for the firm.

Tesla, like the rest of the car industry, has been harmed by widespread parts shortages and rising prices. After Russia invaded Ukraine in February, critical components like semiconductors are still in limited supply, and prices for raw materials like nickel and aluminum have risen. Tesla has been keeping consumers waiting for months in the United States before fulfilling their automobile purchases.

According to some analysts, Tesla might sell 2 million vehicles in 2022, now that a facility near Berlin has begun producing the Model Y for European consumers, posing a threat to German carmakers that now dominate the luxury market. Tesla sells many more electric vehicles than any other automaker, and battery-powered vehicles are outpacing all other vehicle categories. As fuel costs rise and remain high, sales of those automobiles may rise much more. According to Wall Street, Tesla's $1 trillion market cap indicates that it is on course to dominate the industry, too.

OpenSea is closing in on support for Solana NFTs in April, substantially widening the NFT community.

Bitcoin (BTC) dropped below $45,000 during early Asian trading hours on Friday, causing cryptocurrency markets to fall 3.5 percent in the previous 24 hours.

Cardano's ADA and Avalanche's AVAX fell 5%, while Polkadot's DOT, Shiba Inu's SHIB, and Dogecoin's DOGE fell more than 7% in the last 24 hours. Solana's SOL continued to outperform, holding flat on Friday after leading advances on Thursday; BNB Chain's BNB also excelled, dropping 3%.

Bitcoin and other cryptocurrencies were broadly flat on Thursday, holding onto gains from a recent rise as risk sentiment in broader markets froze and investors followed developments in the Russia-Ukraine conflict.

Over $400 million in crypto-tracked futures liquidations occurred in the last 24 hours. Liquidations are forced closings of a trader's leveraged crypto trading position by an exchange owing to a partial or entire loss of the trader's initial margin.

Bitcoin futures had the most future losses, totaling more than $120 million, followed by ether (ETH) futures, which had $63 million in losses. However, because of turbulent trading, some less popular futures lost more than other prominent cryptos on Friday.

Solana (SOL 9.57 percent) soared into double digits in early trade on Thursday, following a massive increase on Wednesday. The cryptocurrency had gained 4.1 percent in the previous 24 hours and had reached a high of 6.2 percent.

Solana is up 25.1 percent in the previous week, indicating a strong run, and its value is rising today as the value of other cryptocurrencies falls. Volatility remains the norm for cryptocurrencies, and at times like these, it benefits Solana investors. However, keep in mind that the gain in prices might be reversed just as fast as it began.

As corporations begin to take Solana more seriously, investors continue to pour into it. Coinbase Global just began trading for several Solana-based tokens, and OpenSea announced yesterday that it will begin holding about 50 Solana non-fungible coins. Many investors who trade exclusively in Bitcoin or Ethereum may be unaware of what is being built atop Solana. Therefore, these movements provide exposure to the ecosystem. As genuine businesses are formed on the blockchain, this should lead to even more investment and increased prices for Solana and its tokens.

While the cryptocurrency industry as a whole appears to have regained its feet in recent weeks, the price of Solana has truly shone. According to CoinMarketCap, Sol has the best performance of any Top 30 cryptocurrency, with a 31 percent gain in the previous seven days. has made some huge movements in the previous several days. Solana's price movement is probably definitely a reaction to NFT marketplace OpenSea's plans to include Solana on the platform in April.

OpenSea, a nonfungible token (NFT) marketplace, has announced the upcoming integration of the Solana (SOL) blockchain within its platform, a long-awaited move that industry experts and numerical data indicate could have reciprocal benefits across both ecosystems, as well as positive sentiments for the wider NFT market. Solana is quickly becoming a big player in the NFT market, with high-grossing titles such as Solana Monkey Business and Degenerate Ape Academy. Both NFT collections have produced over $100 million in lifetime volume, while Aurory's play-to-earn collection has topped the $75 million level. The market will undoubtedly be influenced by OpenSea's backing. For starters, the floor price of Solana-based NFTs and transaction volumes might skyrocket. Solana is also home to DeFi technologies and Web3 programs.

However, there is a danger that Solana NFT markets such as Magic Eden and SolanArt will lose a significant portion of their market share to Solana. Over the previous week, Magic Eden accounted for more than 90% of Solana NFT sales. The change was initially disclosed in January, when tech journalist Jane Manchun Wong declared on Twitter that "OpenSea is working on Solana integration, as well as Phantom wallet compatibility."

Solana will join the list of three networks: Ethereum, layer-2 Polygon, and Klaytn, and will be viewable via the drop-down "all chains" option on the rankings page. OpenSea joyfully referred to the announcement as the "best-kept secret in Web3," referring to the large number of tweets and media stories on the possibility of a Solana launch. Adam Montgomery, the company's head of blockchain, also expressed his thoughts on the launch.

The launch of NFT marketplace LooksRare in January 2022 was the first true leadership threat to OpenSea's multi-year monopoly in the NFT field. It witnessed the implementation of an airdropping scheme, which allowed seasoned investors to claim governance Looks tokens as rewards for using the site.

According to Dune Analytics, LooksRare has registered a total of 55,874 users since its debut on January 10, facilitating almost $21.3 billion in transaction activity. In comparison, since the launch of its competitor, OpenSea has registered 884,052 new members. Nevertheless, these investors have only traded a little more than $12 billion in volume.

Solana is already present in a number of NFT markets, including Magic Eden, Solanart, and Solsea. Based on both user adoption and actual volume counts, Magic Eden holds a rather dominant dominance in Solana's NFT market. The table below breaks out Solana NFT activity during the previous 30 days by the top three markets. In the case of Solana's ecosystem, DappRadar marketplace data shows that Magic Eden now leads the field with a $41.05 million trade volume over the last 30 days, followed by Solanart and Solsea with $4.39 million and 656,830, respectively.

Following Magic Eden's collaboration with Overtime, co-founder Jack Lu told Cointelegraph that NFTs will allow the next generation of sports enthusiasts to enjoy sports in a fundamentally different way than the previous generation of millennials, who grew up passively watching sports on TV or in person.

OpenSea's growth might pose competition to Magic Eden, the primary marketplace for Solana NFTs. The 2% transaction fee charged by Magic Eden is 50 basis points lower than that charged by OpenSea, providing buyers and sellers a modest advantage. It remains to be seen whether this is enough to beat the market leader.

The amount of NFT activity on Solana has recently increased. According to CryptoSlam, 4 of the top 20 NFT collections by 24-hour sales volume are on Solana as of the article's writing. To put things in perspective, Solana hasn't had a single collection in the top 20 in the previous 30 days. As a result, there is a noticeable increase in interest in Solana NFT projects. While a 24-hour sample size is insignificant, NFT sales on Solana exceeded $11 million for the second day in a row on March 30th. The two-day period of March 29–30 was the strongest for NFT sales on Solana since early October. It should also be noted that the number of unique purchasers surpassed 8,600 over that two-day period. It's worth noting that daily unique purchasers have held up rather well in recent months, even when sales have been low. But, once again, the sample size is limited. I believe we can draw some conclusions from the trend in average NFT sale price over the last few months.

While it is no secret that Solana wants to be a lower-cost layer 1 alternative to Ethereum, it appears that Solana is certainly appealing to lower-cost NFT buyers and sellers in the early stages. The average retail price of a Solana-based NFT in August was well over $2,500. As March comes to a conclusion, the average price of Solana NFTs has dropped below $500. When average NFT sales data is compared to ETH and fellow Avalanche, it gives an intriguing perspective.

Avalanche has seen a 44 percent increase in average NFT price since November, when most coin values peaked, but Ethereum and Solana NFTs are still significantly below their highs. While NFT average price drops have been rather severe, especially since August in the instance of Solana, the number of unique NFT purchasers on Solana has been growing.

Solana's average NFT pricing drop has not been due to a lack of interest in the network. It's more of a sign that Solana does, in fact, decrease the barrier to entry for NFT buyers and sellers. While Avalanche has a strong overall trend, Solana has seen significantly greater acceptance as a network for feasible NFT applications than Avalanche or Polygon.

Nonetheless, prudence is advised. Despite the increase in NFT activity on Solana and the significant increase in the price of SOL over the last week or two, the token value is likely still well beyond what would be acceptable based on other measures. After all, NFTs are only a subset of the activity on layer 1 blockchains. Even if I view the NFT action on Solana as generally good, it's critical to examine all on-chain activities when determining whether the performance in SOL is warranted.

When it comes to minting non-fungible tokens, Solana is one of the most popular networks among artists. In recent months, the protocol has emerged as a serious contender to the market leader, Ethereum. Despite its sales volume disadvantage, Solana has certain benefits over its competitor. It employs a Proof-of-History consensus technique, allowing it to execute transactions at a high throughput of more than 60,000 transactions per second (TPS). In comparison, Ethereum presently has a processing capacity of up to 15 TPS.

It is also less expensive to mint NFTs on the Solana network. Because the gas expenses are lower than those of Ethereum, the blockchain technology is more eco-friendly.

In a recent tweet, OpenSea revealed the Solana integration date.

Tesla intends to split its stock in order to pay a stock dividend to investors.

According to a filing with the Securities and Exchange Commission, Tesla, Inc. the electric vehicle manufacturer will request at its annual shareholders meeting to split its stock so that it may pay a stock dividend to stockholders. For the second time in two years, the corporation is seeking its shareholders' approval to split its stock.

This split would take the form of a dividend, with stockholders receiving more shares. Shareholders would essentially get a special dividend of extra shares for each share they already possess. The majority of dividends are paid in cash to investors. Stock dividends are significantly more similar to stock splits than cash dividends. The electric vehicle manufacturer did not specify how many shares investors would receive. Its previous split in August 2020 awarded stockholders five shares for every share owned.

A stock dividend is a dividend paid to shareholders in the form of extra business shares rather than cash. Dividends have no effect on a company's worth, but they dilute its share price. In other words, if there is a 6-for-1 split, investors will get a stock dividend of five shares for every share of Tesla they own. This would be a one-time occurrence.

The date of this year's shareholders meeting, at which the proposal will be voted on, has yet to be announced. Therefore, the timing of the Tesla split remains unknown. The shareholders' meeting was conducted on October 7 last year.

Stock splits do not have a significant impact on a company's value. However, by lowering the price at which shareholders must pay to purchase a single share, they may actually raise demand and therefore the price. When Tesla announced its first stock split in August 2020, it was a 5 to 1 deal. At this moment, it's unclear what kind of split would be suggested for shareholders. The annual meeting of Tesla is normally held in June.

Tesla's stock rose 12.6 percent on the day that its last five-for-one split went into effect. Since then, the stock has more than doubled in value. However, the split occurred in the midst of Tesla's record run, which saw the stock rise 743 percent in 2020.

“Given how well the stock has performed since the previous split, "given how well the stock has performed since the previous split,” said Dan Ives, a Wedbush Securities tech analyst.

Tesla is still a small company compared to other well-known automakers. However, Tesla's quick development the firm expects yearly sales to soar by 50% or more and the expectation that the company would profit from an industry-wide move away from internal combustion engines and toward electric vehicles have spurred remarkable market value gains. Tesla's stock has risen 1884 percent through Friday's closing since October 2019, when the company went from a string of quarterly losses to an unexpected profit. Tesla is currently worth more than the total market capitalization of the world's top 13 manufacturers.

Wedbush Securities analyst Dan Ives has approved the fresh split plan. "We regard Tesla's plan to join the likes of Amazon, Google, and Apple in commencing its second stock split in two years as a wise strategic move that will be a positive driver for shares moving ahead," he said.

In theory, a stock split should not cause shares to rise prior to the split because the company's value has not changed. However, there are other hypotheses as to why a stock split could increase its value. For one thing, if the shares were cheaper, more individual investors would be able to purchase and own shares of the stock, broadening the base of ownership.

Another hypothesis is that when a stock divides, such as when Tesla's stock splits, it is more readily added to various indexes such as the S&P 500 or Nasdaq 100, resulting in more shares being acquired by fund managers who model their portfolios on these indexes. Another idea holds that lower share prices enable lower option pricing in the thriving derivatives market, where retail traders and the Wall Street Bets community are active participants.

When stocks split, the markets quickly react, adjusting the stock price so that investors have the same total amount of value despite holding additional shares, each of which is less valuable. However, whether the same holds true for stock dividends is dependent on the market's efficiency. If the market reacts precisely to changes in supply, prices should adjust proportionately, making a stock dividend equivalent to a tiny stock split, with no actual value flowing to investors, unlike a cash dividend. However, if the market reacts differently to a smaller increase in share supply than to a bigger rise in share supply, owners may be better off. It will be interesting to see if these stock dividends genuinely assist investors.

Tesla acknowledged in a tweet earlier Monday that it was seeking authorization from shareholders to split the stock

Cardano (ADA) has resumed its upward trajectory after surpassing the important $1 price level.

Cardano (ADA) has been on a bullish run in recent days, and the cryptocurrency may continue its upward trajectory after crossing the important $1 price level. Cardano's price has garnered enough upward momentum to breach the crucial $1 resistance level. This is the first time in over a month that ADA has been able to overcome such a large obstacle, allowing it to garner substantial attention from market players. Cardano, on the other hand, might be in for a small correction before moving further.

Cardano's freshly formed staking pools are estimated to be worth roughly 1.5 billion ADA ($1.4 billion). Such a huge sum might signal growing interest from larger market participants and businesses.

The Cardano team is working hard to develop the mainnet in order to provide consumers with a better experience. The company is also working on the chain to outperform competitors such as the gasless Bitgert blockchain, which is now one of the most popular. The Cardano team is continually bragging about how much Plutus, the Cardano wallet, and other components have improved.

Cardano (ADA) has scheduled a Hardfork for the summer of 2022 with the goal of expanding the Cardano protocol and greatly improving transaction throughput, as well as volume and liquidity. Cardano Hardfork called Vasil Hardfork and the Hydra protocol are the two most important upcoming events. And it means a lot for the growth of Cardano protocol, total value locked, and speculatively ada price.

The Vasil Hardfork, named after the Bulgarian mathematician Vasil Dabov, who was also a Cardano community member, is slated for June 2022 and will feature diffusion pipelining, according to the company's creator, Charles Hoskinson.

Matthias Fitzi, a Cardano researcher, outlined the notion in a blog post on the company's website on March 21. According to Fitzi, the most apparent way to do this was to extend the block-size limit to accommodate more transactions per block, with the block size already being increased by 25% in 2022 and future expansions planned. However, there are limits to how large a block can be safely maintained by a ledger-consensus protocol in order for the block production rate to continue at its current level.

Diffusion pipelining addresses this issue by strengthening the consensus layer and raising the budget, allowing for quicker block propagation and validation times. This enables longer blocks and, as a result, higher transaction throughput while keeping the consensus rules constant. These are initiatives aimed at increasing the number of decentralized applications.

Over the course of around 12 hours on March 22, Cardano experienced a massive increase in the amount of ADA deposited into its staking pools. The tremendous flood of Cardano into the 23 freshly formed staking pools totaled roughly 1.5 billion ADA, or around $1.4 billion. In addition, on March 22, the Cardano TVL (Total Value Locked) surpassed $400 million. Given the rising value of TVL and the planned Vasil Hardfork, which is expected to substantially enhance transaction throughput, many analysts expect the Cardano community to grow in lockstep with its currency's value.

With a roughly 7% rise in the last 24 hours, Cardano's ADA led advances among major cryptocurrencies. The price of Polkadot's DOT grew by 6.5 percent, while Ripple's XRP and Solana's SOL both gained by 5%. Bitcoin surged beyond $43,000 overnight, but has now fallen to $42,900 as of press time, still up 4% for the day.

NVIDIA conducted a hack back and claims to have successfully ransomed the hackers' equipment.

NVIDIA Corporation, a US chipmaker, said on Friday that it is investigating a cyber attack that has apparently brought the company's developer tools and email systems down. Parts of its operations may have been knocked offline for two days as a result of the attack.

According to the source, a hostile network breach has "totally penetrated" Nvidia's internal systems, including email and development tools, which have been down since the middle of the week.

"We're looking into an issue." Our commercial and business operations continue unabated. "We are presently evaluating the nature and breadth of the event and do not have any more information to give at this time," said Nvidia spokesperson Hector Marinez in a statement.

While Nvidia has not released any further information regarding the issue, The Telegraph says that the company's email systems and developer tools have been down for the previous two days due to a "malicious network breach."

However, if a US-based corporation, such as Nvidia, was targeted, it may result in reprisal from the US. President Biden warned during his speech on Thursday that "if Russia conducts cyberattacks on our industries or essential infrastructure, we are prepared to retaliate."

It is unclear whether hackers gained access to Nvidia or its customers' data, or whether any of its partners were affected. According to The Telegraph, Nvidia has not yet discovered the offender, and users claim they have not been notified of any problem.

"They'll be checking through everything to see if anything has been modified in their software that they then distributed to their clients, the most serious risk is that something may have been included in one of the software upgrades," Dr. Woodward stated.

The claimed NVIDIA ransomware assault was carried out by a South American hacking team named LAPU, according to experts from the Vx-underground project, which specialized in gathering malware samples. The South American hacking team carried out the attack on NVIDIA's infrastructure, infiltrating the company's internal servers with ransomware and stealing more than 1 TB of data. NVIDIA representatives have yet to corroborate this information, confining themselves to the statement that an inquiry is underway.

The next morning, the LAPU hackers awoke to find that their victim had begun a counterattack: the company's cybersecurity professionals had accessed the assailants' systems and attempted to encrypt the stolen data, according to Vx-underground. The claim was supported by screenshots of encrypted file listings and system alerts about 100 percent CPU utilization. All of the attempts, however, were futile since the hackers had backed up the stolen data.

Coinbase's fourth-quarter earnings outperformed analyst expectations. Why is the stock dropping?

Coinbase Global Inc. earnings were above Wall Street forecasts in the fourth quarter, with income more than quadrupling as the largest U.S. cryptocurrency exchange benefitted from a wild period that saw bitcoin establish a record before plummeting drastically.

Coinbase reported net income of $840 million, or $3.32 per diluted share, in the fourth quarter, while its monthly active user base increased to 11.4 million, the company said Thursday, compared to earnings of $177 million on net revenue of $497 million the previous year.

In after-hours trading on Thursday, shares of the cryptocurrency exchange fell more than 3% to $172. The stock price of Coinbase, which has been hovering around an all-time low in recent weeks, does not appear to have risen as a result of Thursday's earnings announcement.

The company expected that retail monthly transaction users and overall trading volume would be lower in the first quarter than in the previous period. Coinbase ascribed the shift to lower crypto asset volatility and a 20% drop in crypto market capitalization year to date. According to the corporation, the decline in market capitalization is being driven by macroeconomic reasons such as geopolitical uncertainty and the Federal Reserve's suggestion of a tightening of financial conditions.

The revenue number was the biggest ever for Coinbase, topping the $1.97 billion consensus projection, while the user count, which was also a record, reversed a previous slide that saw the company's user base decrease to 7.4 million in Q3. Despite a general increase in value in 2021, the main cryptocurrencies had a bad month in December, according to the research. Concerns over cryptocurrency's energy usage, as well as macroeconomic variables such as the growth of the COVID-19 omicron version, were blamed by investors for the year-end downturn.

Coinbase produced $840 million in earnings last quarter, more than double the previous quarter's profit but falling short of the $1.6 billion it made in the second quarter of last year. Revenues at the exchange increased to $2.5 billion in the fourth quarter of 2021, exceeding analysts' expectations of $2 billion. It had 3,730 workers by the end of 2021, more than three times the amount it had in 2020.

Lower "subscriptions and services revenues" than in the previous quarter, which, together with the aforementioned datapoint, suggests that Coinbase's top-line would fall dramatically in Q1 2022 compared to Q4 2021.

In a letter to shareholders, Coinbase warned that the year 2022 will continue to be unclear for the company.

"We approach 2022 with even more unknowns," the company warned, citing "global macroeconomic challenges" in addition to "unpredictable crypto asset values," increasing interest rates, and inflation. On the other hand, it stated that it sees growing bitcoin prospects and acceptance.

The outstanding results were undoubtedly fueled by record-high crypto prices in October and November, when Bitcoin nearly reached $70,000 and the frenetic trading that followed. Given the weak market that has defined 2022 thus far, they are unlikely to be replicated.

The Coinbase results also revealed that Ethereum's share of trade volume, which had previously surpassed Bitcoin, had dropped to 16 percent last quarter. Other assets, including Dogecoin, Shiba Inu, and others, saw their volume increase from 59% to 68%.

According to the company's results, over $200 million of Coinbase's income comes from non-trading methods such as staking and lending. While this represents less than 10% of Coinbase's total income, it indicates that the business is finally diversifying away from the trading fees on which it has long relied—and which many fear are under threat from commission-free platforms like Robinhood.

Tesla supercharging station will take Dogecoin as payment.

On Saturday, Elon Musk, CEO of Tesla and SpaceX, revealed on Twitter that the company's supercharging station will take Dogecoin as payment.

Elon Musk has not specified what users will be able to pay for with the cryptocurrency. Some speculate that Tesla supercharger stations would take dogecoin, while others view Musk's post as referring specifically to the forthcoming Hollywood café and drive-in cinema.

However, this news has had little impact on the price of dogecoin. Dogecoin was trading around $0.1416 at the time of Musk's post. While the price rose slightly to $0.1452, it then dropped to $0.1412.

Nonetheless, advocates of Dogecoin applaud Musk's effort to expand the parody cryptocurrency's popularity. Musk, a strong supporter of both Doge and Bitcoin, has long hinted about using Doge as a payment mechanism across several aspects of Tesla's operations. Doge is accepted at the company's online store, and there have been rumors that Tesla would accept the cryptocurrency as a means of payment for its automobiles in the future.

Last year, Musk stated that because Bitcoin mining is "moving towards sustainable energy," his business would likely begin taking Bitcoin as payment for its electric vehicles. Musk claims that if he determines that Bitcoin mining uses 50% or more renewable energy, Tesla will resume accepting payments.

Due to worries over the usage of fossil fuels in mining, the digital currency was halted in May 2021 due to worries over the digital currency's plummet.

In a tweet on Thursday, he expressed concern about the "huge usage" of coal and other carbon-intensive energies to create the electricity needed to mine digital currency. Tesla said in February of last year that it had acquired $1.5 billion in Bitcoin and planned to accept it as payment, sparking a spike in both the company's stock and the currency.

In a recent interview, he also backed Dogecoin over any other crypto currency.

"The transaction value of Bitcoin is low, and the cost per transaction is high. At least on a spatial level, it is appropriate as a value-storage medium. But, at its core, Bitcoin is not a good alternative for transactional currency, "he added, adding that, despite its origins as a joke, Dogecoin is better suited for transactions.

Musk tweeted in January saying that Tesla would take Dogecoin as payment for some Tesla merchandise.

Musk then attempted to persuade McDonald's to embrace DOGE by eating a Happy Meal on television. Read more here.

Musk also acknowledged that, in addition to Tesla's investment, he has a sizable personal bitcoin position, as well as lesser Ethereum and Dogecoin holdings.

The value of the global cryptocurrency market declined as tensions between Russia and Ukraine have increased.

Following recent advances, crypto traders have been defensive as tensions between Russia and Ukraine have increased. The value of the global cryptocurrency market declined 1.47 percent to $1.83 trillion in the previous 24 hours, while trade volumes plummeted 16.75 percent to $72.95 billion.

Stablecoins accounted for 80.75 percent of the $58.91 billion in 24-hour cryptocurrency trading volume, while decentralized finance (DeFi) contributed 12.29 percent, or $8.97 billion.

On the morning of February 19, Bitcoin's market dominance increased by 0.06 percent to 41.72 percent, and the currency was trading at $40,208.63.

Binance Coin has dropped roughly 2% to $413. Avalanche was down 0.58 percent and Cardano was down 1.35 percent. In the previous 24 hours, Polkadot was down 1.75 percent while Litecoin was down 2.65 percent. Tether was up 0.09 percent.

Ether, the cryptocurrency tied to the Ethereum blockchain and the second-largest cryptocurrency by market value, fell to $2,763.10 as well.

The second-largest cryptocurrency by market capitalization, Ethereum (ETH), has been the subject of a new report from Morgan Stanley's wealth management global investment office, which warns that it may lose market dominance and smart contract superiority to cheaper and faster networks like Solana, Cardano, Tezos, Polkadot, and others. Ethereum is more volatile than Bitcoin, and it faces greater competitive threats, scalability concerns, and complexity challenges than Bitcoin due to its more ambitious addressable market.

According to the investment bank's researchers, Ethereum offers a higher investment risk than bitcoin since it requires fewer transactions per user to utilize BTC, which is similar to a decentralized savings account, but ETH demand is more tightly related to transactions.

This indicates that scaling limits may have a greater impact on Ethereum demand than they do on Bitcoin demand. The experts also looked at the regulatory status of decentralized financial apps and non-fungible tokens, which might see authorities crack down on them in the future, limiting demand for Ethereum transactions.

While Ethereum is more centralized than Bitcoin, with the top 100 addresses controlling 39 percent of Ether, compared to 14 percent for Bitcoin, the paper claims that its transaction-based burning mechanism gives it greater market potential and deflationary characteristics.

According to statistics from the blockchain, roughly $800,000 worth of Ethereum being destroyed every hour, with over $5 billion worth of the cryptocurrency already burned, as CryptoGlobe reported late last year. According to Morgan Stanley, when Ethereum switches to Proof-of-Stake, its performance will dramatically increase.

In particular, JPMorgan researchers led by Nikolaos Panigirtzoglou have stated that when it comes to non-fungible tokens, Ethereum is losing market share to competitors such as Solana (NFTs). As a result of the cryptocurrency's network's high transaction costs, Ethereum's volume share of non-fungible token trading decreased from 95 percent at the start of 2021 to 80 percent, according to the experts.

Morgan Stanley analysts downplayed bitcoin's 50% loss from its all-time high in November in a research note titled "State of the Bear Market" earlier this month, citing metrics that demonstrate the decrease was within historical averages.

According to an announcement made today, senior officials at the Federal Reserve would no longer be permitted to possess cryptocurrency, as well as conventional assets such as stocks. The new limits spelled forth for investment and trading activities of senior officials in a statement from the Federal Open Market Committee (FOMC), the body of the Fed that decides monetary policy direction.

Senior Federal Reserve officials will no longer be able to purchase cryptocurrency, individual stocks, or sector funds, or maintain investments in individual bonds, agency securities, commodities, or foreign currencies, according to the FOMC. They are also prohibited from engaging in derivatives transactions, short sells, or margin purchases.

Bitcoin has lost around 35% of its value since peaking at over $69,000 in November of last year, as risk aversion rises as the Federal Reserve and other global central banks tighten financial conditions and remove pandemic-era liquidity from the system.

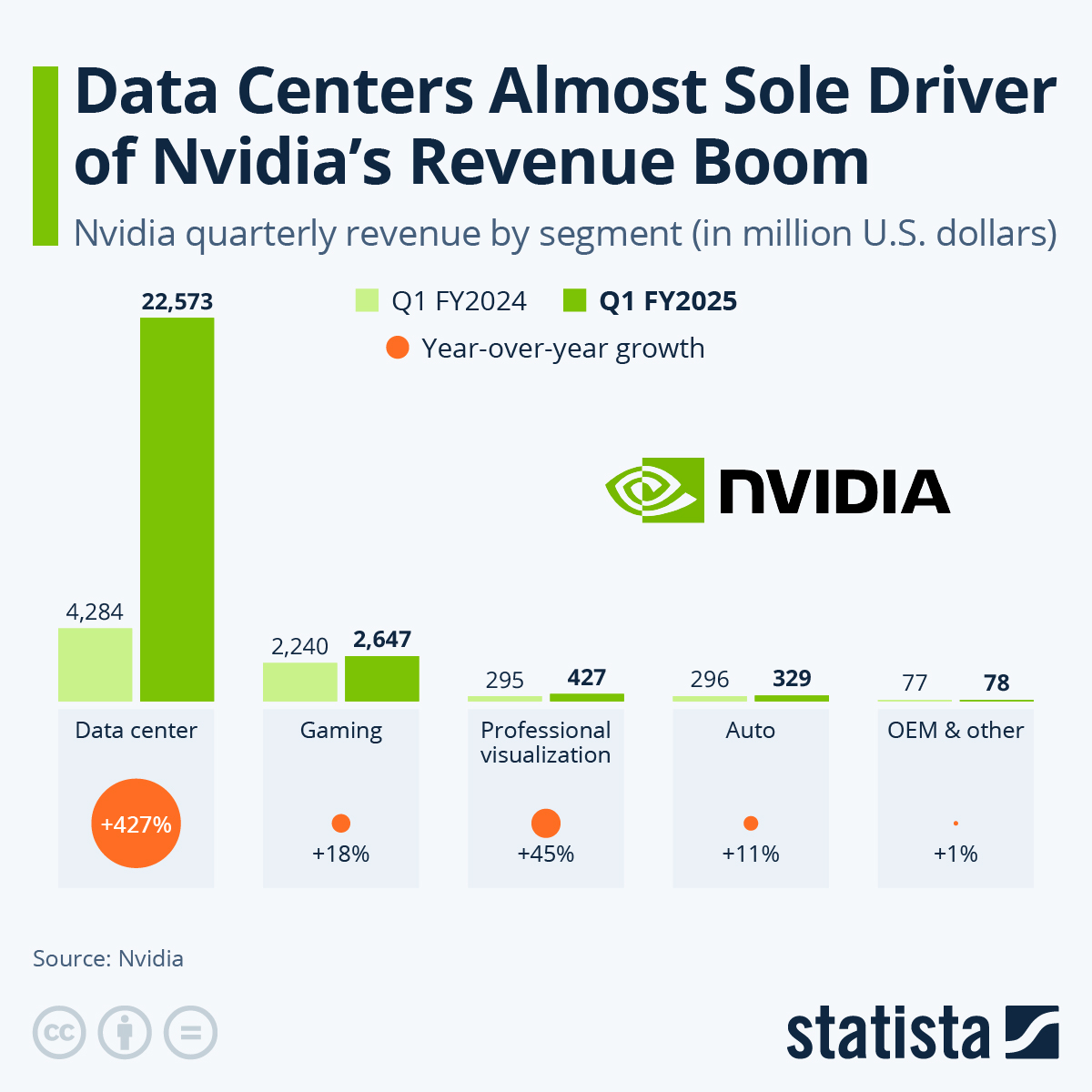

Nvidia's shares tumbled on Thursday, despite the fact that the company reported its fourth-quarter earnings on Wednesday that exceeded Wall Street's forecasts.

On February 16, 2022, Nvidia Corporation posted Q4 FY results that were above forecasters' estimates. Adjusted earnings per share increased 69.2 percent year over year, exceeding analyst expectations. In the most recent quarter, the graphics-chip manufacturer reported $7.64 billion in revenue, a 53 percent increase over the previous year. Analysts' projections for data center revenue were surpassed. In extended trading, the company's stock slid about 2%. Nvidia's shares have produced a total return of 73.1 percent over the last year, far outperforming the S&P 500's total return of 13.8 percent. It reported $3 billion in net profits, more than double the previous year's number, and outperformed Wall Street on both profit and sales. As it moves on from its unsuccessful acquisition effort of semiconductor-design specialist Arm Ltd, the firm reported record quarterly sales throughout its business and forecasted an increase in the current period. Investors are anticipating a strong earnings report from Nvidia, which is still experiencing all of the demand it can manage from gamers and cloud giants.

Nvidia Corp. fell 7% in pre-market trade on Thursday after the chipmaker reported better-than-expected fourth-quarter results but provided a cautious view on profit margins in the short term. Despite exceeding Wall Street forecasts with its fourth-quarter earnings and forecasting good growth for the current period, the share loss is a reflection of Wall Street's high expectations following Nvidia's withdrawal from a $40 billion acquisition of Arm Ltd. earlier this month.

Nvidia's data center revenue increased 71.5 percent year on year, outpacing the prior quarter's growth rate. Colette Kress, Nvidia's Chief Financial Officer, stated that data center revenue was largely driven by sales of Nvidia Ampere architecture GPUs. Last quarter, there were some hiccups. Nvidia's vehicle processors were sold at a lower rate than expected. And its adjusted gross margin was 67 percent, which was lower than the 67.1 percent predicted by analysts and lower than what several chipmakers have recently reported. Analog Devices Inc. reported a 72 percent margin in its quarterly earnings released earlier Wednesday.

Nvidia had record gaming sector revenues of $3.42 billion, as well as an all-time high in data center revenues of $3.26 billion, but slowing sales of its "CMP" chips, which are used by cryptocurrency miners, added a degree of concern to the chipmaker's outlook, with gross margins likely remaining at 67 percent in the current quarter. The firm has long focused on manufacturing chips for the gaming and graphics industries, and it was a pioneer in the creation of GPUs. It turns out that the powerful processing capabilities used by GPUs to power video games and graphics applications are also well-suited for artificial intelligence (AI) and machine learning. Both of these technologies are becoming more essential in the constantly expanding data center business. During the pandemic, demand for remote computer power surged significantly as more individuals began working from home and businesses were compelled to transfer certain activities online. This advancement has contributed to an increase in demand for Nvidia's data center CPUs.

The company's CEO, Jensen Huang, discussed the company's supply chain problems. "In the next quarters, we expect supplies to improve," he added. The business claimed it has $9 billion in long-term supply agreements, up from $2.54 billion a year earlier, as an indication of how it is tackling supply chain concerns.

Increased attention to the metaverse, a virtual environment based on technologies such as virtual reality (VR) and augmented reality (AR), is expected to drive up demand for the company's data center processors. Nvidia revealed in January that Meta Platforms, Inc. aims to use NVIDIA DGX A100 computers to develop the metaverse of their AI Research SuperCluster (RSC). Meta's AI supercomputer is likely to be Nvidia's DGX A100 systems' biggest client installation.

Following a January-quarter tally of $7.64 billion, Nvidia plans to produce roughly $8.1 billion in revenue in Q1 FY 2023, reflecting a YOY rise of nearly 42 percent. On May 12, 2022, Nvidia is expected to release their next earnings report for Q1 FY 2023

Stocks rise on hints of reducing conflict between Russia and Ukraine.

On Tuesday, U.S. market index futures rose on reports that Russia was withdrawing some soldiers from near the Ukrainian border, indicating a de-escalation of hostilities between the two nations.

Worries about a Russian attack on Ukraine roiled markets around the world on Monday, with all three major stock indexes finishing lower for the third straight trading day, with the S&P 500 index posting its biggest three-day drop since October 2020, as US allies warned of an impending attack by Russian forces on Ukraine. Investor sentiment varied throughout the day on Monday as the Russia-Ukraine conflict unfolded.

According to RBC analysts, stock market dips before a conflict are similar to "growth scares." The S&P 500 index plummeted more than 19% from peak to trough during the 1990 Gulf War, a drop consistent with a recession that year. The S&P 500 fell 33% during the second Iraq war in 2003, when "investors were still grappling with the aftermath of the tech boom, as well as the accounting scandals that defined the early 2000s".

Russia's defense ministry stated that after finishing maneuvers, several troops in military districts bordering Ukraine were returning to their posts, easing worries of a clash in the region.

In premarket trading, large growth companies such as Tesla Inc, Apple Inc, Amazon.com Inc, Microsoft Corp, and Meta Platforms Inc surged between 1.6 percent and 3.0 percent. The Dow electronic futures rose 310 points, or 0.9 percent, the S&P 500 electronic futures rose 56.25 points, or 1.28 percent, and the Nasdaq Composite index climbed 268.25 points, or 1.8 percent, thanks to significant weightings of highly valued technology firms that are susceptible to market mood fluctuations.

After Russia announced it had moved some troops from the Ukraine border and downplayed invasion concerns that had unsettled markets in recent days, US and European stocks rose while oil prices dipped. However, it remained unclear if this was a transitory indicator of a substantial downturn.

Next-month European gas futures decreased 8.5 percent to €73.26 per megawatt hour.

On Tuesday, Asian stock markets fell and safe-haven assets such as gold climbed as investors considered the ramifications of a possible Russian invasion of Ukraine. After stock markets in the United States and Europe lost momentum on Monday, MSCI's broadest index of Asia-Pacific equities outside Japan was down 0.5 percent. Japan's Nikkei 225 fell 0.91 percent, while Australia's S&P/ASX 200 fell 0.51 percent. The Hang Seng index in Hong Kong fell 1.1 percent, while China's CSI 300 Index rose 0.7 percent, bucking the regional sell-off trend. As investors sought shelter in the classic safe-haven commodity, the stock market sell-off fueled by risk aversion helped boost gold to an eight-month high.

After falling nearly 2% on Monday, the Stoxx Europe 600 stock index rose 1.2 percent on Tuesday. The Russian ruble gained 1.7% versus the US dollar. The hryvnia, Ukraine's currency, increased by 0.9 percent. The FTSE 100 in London increased by 0.7%, while the Xetra Dax in Germany increased by 1.6%.

The price of haven assets declined, with the US dollar index down 0.3 percent. The yield on Germany's 10-year Bund increased 0.05 percentage points to 0.32 percent, moving in the opposite direction of the security's price.

According to Unigestion cross-asset fund manager, the Russia-Ukraine problem has arisen at an unfavorable moment for markets, who is pointing to estimates that the US Federal Reserve will hike interest rates seven times this year after holding borrowing costs near zero since March 2020.

Coca-Cola’s Earnings and Revenue Beat Estimates.

Coca-Cola posted quarterly earnings of 45 cents per share on Thursday, topping analyst expectations of 41 cents per share. This compared to a year ago earnings of 47 cents per share. Coca-Cola's stock is up after the company released profits. The firm has outperformed consensus EPS projections four times in the previous four quarters. On $38.7 billion in revenue, annual profits were $2.32 per share.

Higher inflation will continue to impact on the company's profitability into 2022, according to the company's weaker-than-expected projection. PepsiCo, a competitor, issued a similar warning to investors about growing packaging and shipping costs.

This world's largest beverage company was projected to report earnings of $0.58 per share a quarter ago, but instead reported $0.65 per share, a 12.07 percent surprise. For the quarter, the beverage behemoth earned $2.41 billion, or 56 cents per share, up from $1.46 billion, or 34 cents per share, a year ago.

Coca-Cola's revenue for the quarter ending December 2021 was $9.46 billion, exceeding analysts' forecasts of $8.9 billion. According to the corporation, the quarter's revenue was harmed by six fewer days than the previous year and the timing of concentrate shipments. This compared to $8.61 billion in sales a year earlier. Volumes in Coca-Cola's carbonated soft drinks division, which includes its trademark soda, increased by 8% in the third quarter. Coke Zero Sugar grew by double digits. In the third quarter, Coke's hydration, sports drinks, coffee, and tea segments witnessed a 12 percent increase in volume. Sports drinks showed the greatest increase in volume changes, owing to the company's recent acquisition of Body Armor.

The stock's immediate price movement based on recently revealed figures and future earnings forecasts will be largely determined by management's remarks on the earnings call. Coca-Cola shares has gained around 3 percent since the beginning of the year, while the S&P 500 has lost-3.8 percent.

Coke anticipates a 5% to 6% growth in comparable profits per share in 2022, compared to the 6.1 percent gain projected by Wall Street analysts. Earnings are projected to be cut by the mid-single digits as commodity prices rise. The company also predicts organic revenue growth of 7% to 8% for the entire year. Coca-Cola expects to generate $10.50 billion in free cash flow in fiscal year 2022. This leads investors to believe that Coca-Cola will surprise them with a new distribution of 44 cents per share next week.

To put it gently, the 2022 market has been odd. The first trading day of the year witnessed significant increases in speculative and growth companies, but January proved to be the worst start in many years for numerous equities and sectors. As January proceeded, a regular pattern formed in which value and dividend stocks attracted some offers. As a consequence, Coca-Cola is up 3% year to date, while the other three main indexes are down.

Netflix's stock plummeted more than 26% after the company announced fourth-quarter 2021 earnings on Jan 20, 2022.

Netflix's stock plummeted more than 26% after the company announced fourth-quarter 2021 earnings on Jan 20, 2022. Earnings per share (EPS) increased by 11.8 percent, exceeding expectations. Analysts predicted that earnings per share would fall 31.2 percent. Netflix's revenue increased 16.0 percent year over year, narrowly matching analyst expectations. The average revenue per subscriber on Netflix was $11.72. Average revenue per user rose year over year in every location where it operates, excluding the effects of currency rates.

It was the weakest quarter of sales growth in the previous four years. Worldwide paid streaming memberships, also known as global paid streaming subscribers, totaled 221.8 million in the third quarter, falling short of experts' estimates. In after-market trade, the company's stock dropped as much as 15%. Over the last year, Netflix's stock has returned 13.1 percent, trailing the S&P 500's 16.4 percent total return.

While the price has subsequently rebounded, the initial decrease appears to be linked to recent management recommendations. In the first quarter, investors can expect lower-than-average subscriber growth.

Investors anticipate a 2.5 million subscriber increase in the first quarter of 2022. Because Netflix typically adds millions more in the first quarter, this was far less than the market anticipated. In the first quarter of the last five years, Netflix has averaged an increase of 8.38 million subscribers. Netflix's estimated audience of 2.5 million is nearly 5.88 million lower than its average.

By combining Netflix's $11.72 average income per user with 5.88 million fewer members, the company will lose $69 million each month in revenue, or $827 million yearly. Netflix's revenue in 2021 was $29.7 billion, thus the gap is merely 2.8 percent. However, because the majority of Netflix's incremental income goes to the bottom line, it becomes more significant. Netflix's net income was $5.1 billion. If you assume that $700 million of the $827 million went to net income, you're looking at a 13.7 percent deficit.

Netflix has a significant degree of leverage in general. Whether it has 100 million or 200 million users, its costs are virtually the same. As a result, the additional subscribers have a greater impact on profitability and cash flow than if the expenses were more variable. The number of subscribers has a significant impact on the stock price.

Netflix's global premium streaming subscriptions increased by 8.9% year over year, the slowest growth rate in at least 14 quarters. The number of worldwide users who have signed up for and paid for a subscription to get streaming services is represented by global paid streaming memberships.

Netflix is also investing in other forms of streaming entertainment, such as video games. Members may access games from within the Netflix mobile app, according to the business, which launched its mobile games on Android and iOS in November. In 2022, it intends to keep extending its gaming portfolio.

Netflix's strategy includes a focus on expanding its streaming subscription business overseas, as it is the company's primary source of income. By the conclusion of FY 2020, Netflix has crossed the 200 million mark in total global paid streaming memberships.

Ford's shares tumbled as much as 5% in after-hours trading on Thursday after the automaker's fourth-quarter earnings fell short of Wall Street's forecast.

Ford Motor Company finished 2021 with $36 billion in cash, a slew of hot-selling new electric vehicles, and a strong estimate for sales and profit growth this year, but it wasn't enough to satisfy investors. Despite the fact that the number of automobiles it sold globally fell by 11% to 1.1 million. Because of the ongoing chip scarcity and supply chain concerns, most major automakers throughout the industry have been forced to temporarily halt their plants and curtail output during the quarter, resulting in limited stocks of new vehicles accessible to customers. As a result, automobile costs have reached new highs, reducing the need for automakers to give incentives to entice consumers.

The fourth-quarter net income increased to $12.3 billion, up from a $2.8 billion loss the previous year. Earnings before interest and taxes increased to $2.0 billion from $1.7 billion the previous year.

The business recorded $1.1 billion in profits excluding extraordinary items, down from $1.4 billion on the same basis a year earlier.

Ford enters 2022 in a better financial situation than it has been in for a long time. According to the corporation, it has $36 billion in cash and $52 billion in liquidity. These figures reflect Ford's investment in Rivian Automotive Inc (RIVN.O), which is valued at $10.6 billion by the end of 2021. For 2022, Ford expects to earn between $11.5 billion and $12.5 billion in adjusted pretax earnings and $5.5 billion to $6.5 billion in adjusted free cash flow.

Ford anticipates a 25% increase in full-year operating earnings this year as several of its worldwide units that lost money in the quarter, such as Europe and China, return to profitability. Vehicle sales are expected to fall in the first quarter of 2022 as a result of persistent supply chain challenges and a worldwide semiconductor shortage.

Customers have bought or requested more than 275,000 electric F-150 Lightnings, vans, and electric Mustangs. By the end of 2023, the corporation reaffirmed its objective of producing 600,000 electric vehicles per year.

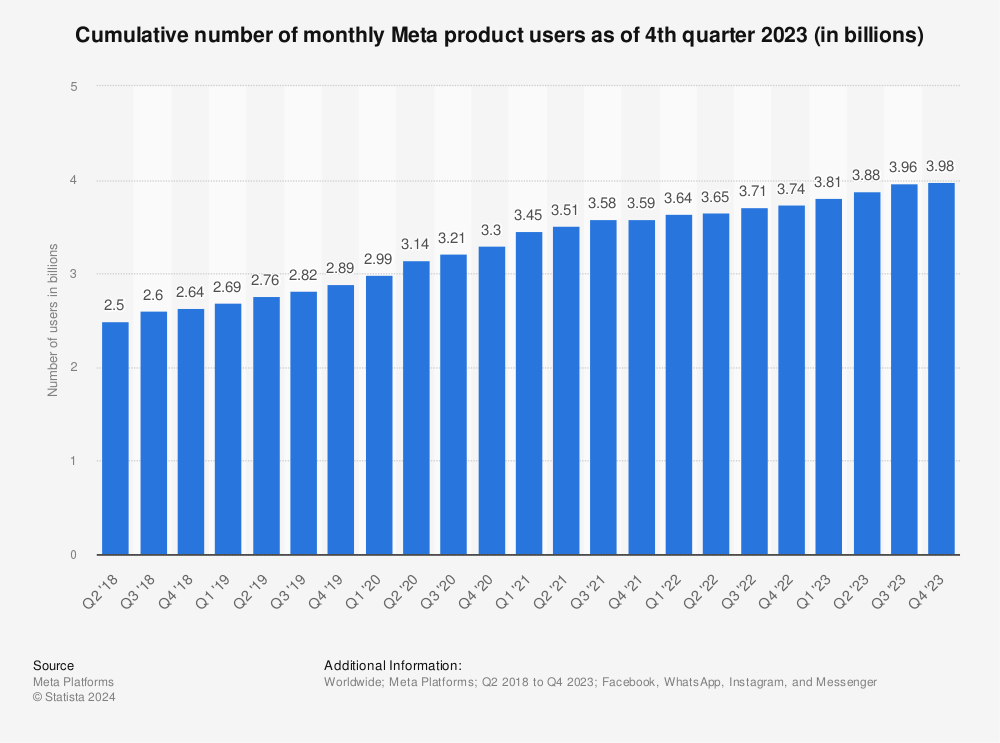

Facebook's daily active users fell short of analyst expectations. Meta Platforms Inc. has dropped more than 25% after it released a disappointing earnings report on Wednesday.

Meta stock fell in extended trading on Wednesday after Facebook owner Meta Platforms released its fourth-quarter earnings report, sending the company's stock down 23% in after-hours trading Wednesday and nearly 20 percent in Thursday's premarket. It was the first set of quarterly results for Facebook's parent company, Meta, under its new name.

Earnings per share fell 5% year on year to $3.6, falling short of forecasts of $3.8.

The stock is on track for its biggest one-day drop ever, surpassing the 19% drop it experienced in July 2018.The loss on Thursday is expected to reduce its market capitalization by roughly $210 billion, lowering it to around $689 billion.

Facebook is investing more aggressively in products that make less income in the immediate term but have high growth potential, such as Reels on Instagram. The company's primary social media business, reported under its family of apps, generated $32.79 billion in sales and $15.89 billion in operating profits in the quarter.

However, it should be noted that overall income increased in the three months to December, rising to $33.7 billion from $28.1 billion at the same time last year. Net income was $10.3 billion for the quarter, down roughly $1 billion from the previous year. Despite this, Meta is a highly wealthy and lucrative company.

Facebook's daily active users fell short of analyst expectations, totaling 1.929 billion in the three months to the end of December, compared to 1.84 billion in the same period last year. They were down from 1.93 billion in the prior quarter. It saw its first drop in daily active users since the company's inception in 2004. A reduction in the number of individuals who check in to Facebook every day indicates that the company's core product has achieved saturation in global markets, meaning that it may no longer be able to grow its user base.

Facebook's monthly user base remained largely stable at 2.91 billion.

Alphabet Inc., The Parent Company of Google, Has Made Its Stock More Accessible To Retail Investors.

Alphabet Inc Google's parent company is reintroducing large stock splits to the market, so potential buyers won't have to pay a four-digit figure to own a share. Google has announced a 20-to-1 stock split. That means that following the split, there will be 20 times as many GOOG shares accessible as there are now. Lowering the price does something else for Google parent Alphabet Inc. It allows America's third-largest firm to be included in its most prestigious stock index.

Alphabet revealed its fourth-quarter earnings yesterday, causing the company's shares to rise more than 10% in pre-market trade. However, another cause for the price increase might be Google's huge announcement about splitting its stock.

A stock split occurs when a company decides to divide its shares by a specific factor. This results in more shares than existed prior to the split. For example, if you buy one share of GOOG today, you will have 20 shares once the company splits 20-to-1.

The Wall Street Journal reports that stockholders of record on July 1, 2022 will get an additional 19 shares for every share they possess on Friday, July 15. On Monday, July 18, the stock will begin trading at its split-adjusted price.

Elon Musk’s Support For Dogecoin.

Elon Musk, the billionaire entrepreneur, is a well-known cryptocurrency enthusiast who has frequently declared his support for cryptocurrencies on social media. He has, however, recently focused his efforts on supporting one specific coin, Dogecoin. The SpaceX and Tesla CEO recently reaffirmed his support for the joke coin, stating he would be glad to eat a McDonald's meal on television if the fast-food business accepted Dogecoin payments.

Dogecoin was founded in 2013 by software developers Billy Markus and Jackson Palmer as a speedier alternative to Bitcoin. It began as a spoof on the several fraudulent cryptocurrency currencies that had sprouted up at the time, and it draws its name and emblem from a Shiba Inu meme that went viral several years ago.

Tesla has also revealed that Dogecoin may now be used to purchase Tesla products.

The decision, which increased Dogecoin prices by 14 percent, comes a month after Musk said that Tesla would test the digital currency as a payment alternative. Musk, a prominent proponent of cryptocurrencies, has had a significant impact on the values of Dogecoin and bitcoin, and at one time stated that the firm would accept bitcoin for the purchase of its automobiles before abandoning the notion.